New York State and Local Retirement System (NYSLRS) Enhanced Reporting

Human Resources > State Requirements > NY

New York State and Local Retirement System (NYSLRS) reporting has been upgraded to accommodate an enhanced file format.

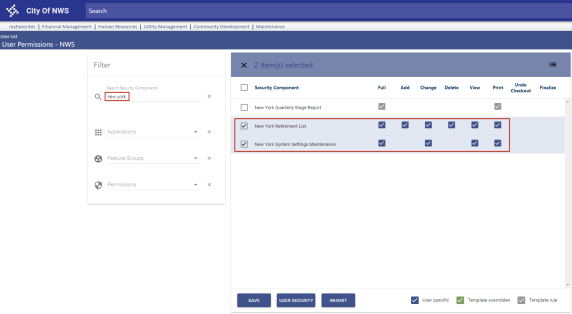

Users need permission to two security components, New York Retirement List and New York System Settings Maintenance:

- Navigate to Maintenance > new world ERP Suite > Security > Users. The User List page opens.

- Use the filter in the User Name column to search for the user.

- Select the user’s row.

- Click Permissions. The User Permissions page opens, containing a grid of security components and a filter panel.

-

In the Search Security Components filter, type New York (the entry is not case sensitive). The grid reloads to contain the New York security components:

- Select Full permissions for the New York Retirement List component.

- Select Full permissions for the New York System Settings Maintenance component.

- Click Save.

- For the permissions to take effect, the user must log off and log back onto the system.

The following validation sets and user-defined fields (UDFs) required for NYSLRS Enhanced Reporting come preloaded with this update:

| Validation Sets | |

|---|---|

| Set Number | Name |

| 616 | New York NYSLRS Job Code |

| 617 | New York NYSLRS Employee Class |

| UDFs | ||

|---|---|---|

| Record Type | Name | Data Type |

| Employee Employment |

NYSLRS ID (Values provided by state) |

Text |

| Employee Job | NYSLRS Employee Class | Validation Set |

| Employee Job |

NYSLRS Employment Instance (Values provided by state) |

Numeric |

| Employee Job | NYSLRS Job Code | Validation Set |

Note: To be included in the initial NYSLRS report and transmittal upload, an employee must have a selection in the NYSLRS Job Code UDF. Job codes are defined by the state of New York.

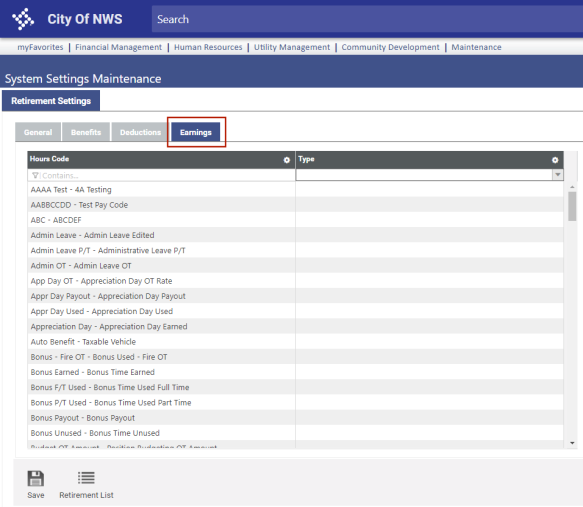

Human Resources > State Requirements > NY > System Settings Maintenance

Before creating your state retirement data, you need to perform additional setup on the new System Settings Maintenance page. The setup includes the selection of a reporting type and location code, the mapping of employment statuses and job events to the appropriate NYSLRS statuses, the mapping of benefit and deduction codes to system IDs and the mapping of contribution type codes and hours codes to earnings type codes.

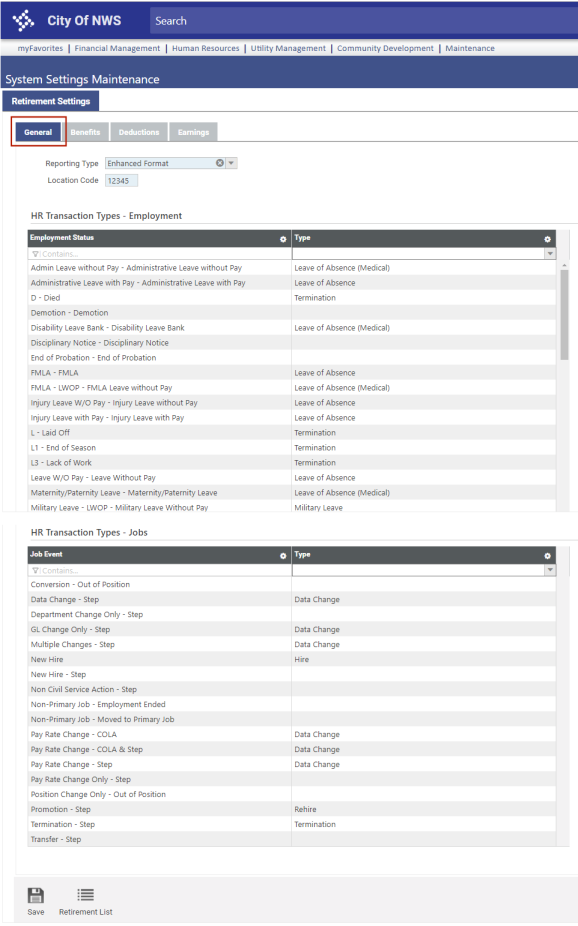

The System Settings Maintenance page contains four tabs: General, Benefits, Deductions and Earnings.

This tab contains fields for selecting the reporting type and location code, a grid for mapping employment statuses and a grid for mapping job events:

The Reporting Type drop-down contains two options, Enhanced Format and Legacy Format. The Enhanced Format is selected by default.

The Location Code is the header that appears on the top of every transmittal file.

In the Employment Status grid, statuses built in New World ERP appear in the left column. Cells in the right column are drop-downs containing NYLSRS statuses that come from validation set 612. If you report employment statuses, map the relevant statuses on the left to the NYLSRS statuses you report.

These selections update record 2 on the transmittal file.

In the Job Event grid, job events built in New World ERP appear in the left column. Cells in the right column are drop-downs containing NYLSRS statuses that come from validation set 612. If you report job events, map the relevant events on the left to the NYLSRS job events you report.

These selections update record 2 on the transmittal file.

Note: To be included in the initial NYSLRS report and transmittal upload, an employee must have at least one job event or one employment event that is mapped in System Settings Maintenance.

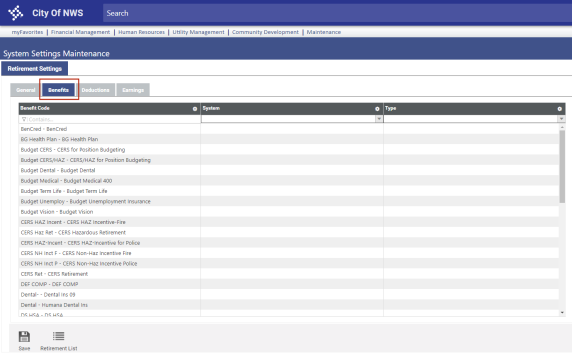

On the Benefits tab, for contributions the employer makes on behalf of employees, map benefit codes in the left column of the grid to the appropriate System ID and contribution Type codes in the center and right columns, clicking the Save button after each selection.

Anything mapped here and used in a payroll will be reported on record 3 (Contributions) of the transmittal file.

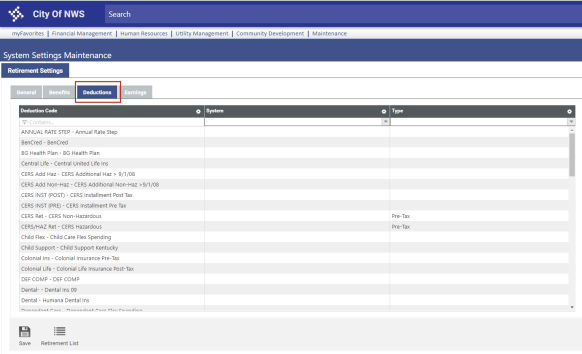

On the Deductions tab, for employee contributions, map deduction codes in the left column of the grid to the appropriate System ID and contribution Type codes in the center and right columns, clicking the Save button after each selection.

Anything mapped here and used in a payroll will be reported on record 3 (Contributions) of the transmittal file.

The left column of the grid on the Earnings tab contains all active hours codes. Map hours codes to the appropriate earnings type codes in the right column, clicking the Save button after each selection. Anything mapped here and used in a payroll will be reported on record 4 (Earnings) of the transmittal file.

Note: To navigate back and forth from this page to the New York Retirement List page while performing setup and running reports, use the Retirement List button on this page and the Settings button on the New York Retirement List page.

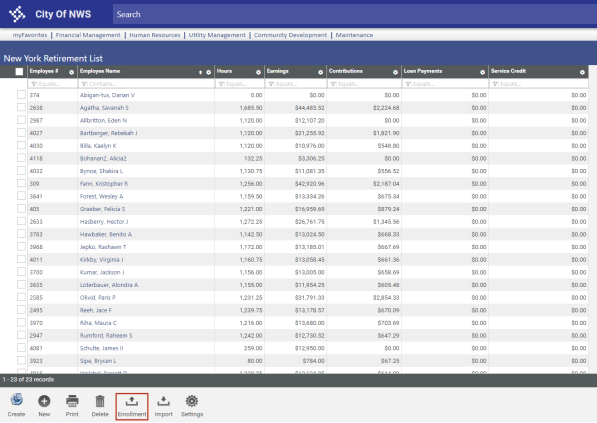

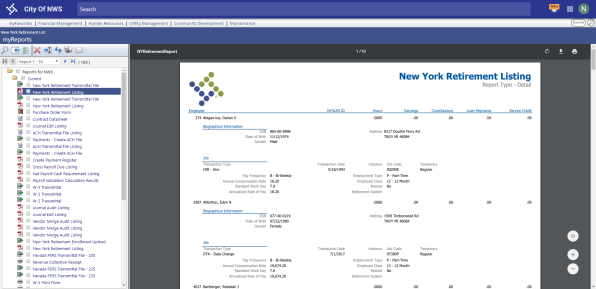

Human Resources > State Requirements > NY > Retirement List

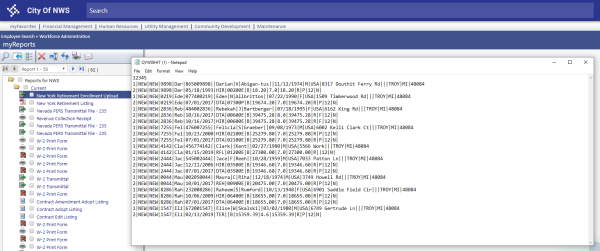

Use the Enrollment button on the New York Retirement List page to generate a Notepad file containing every eligible retirement system employee in Workforce Administration who has an NYSLRS Job Code selected on the Workforce Jobs tab and at least one employment status event or one job status event mapped in System Settings Maintenance but is missing the state-provided NYSLRS ID on the Workforce Employment tab or the state-provided NYSLRS Employment Instance on the Workforce Jobs tab:

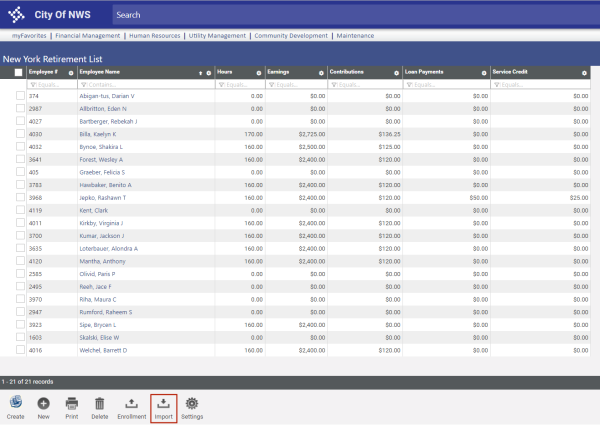

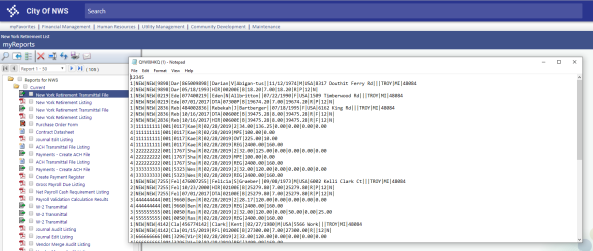

You may upload this file to the state. The state in turn will send a .csv file containing an NYSLRS ID and NYSLRS Employment Instance for each employee who appeared on the enrollment file. To avoid having to enter this data manually on each employee's Workforce Employment and Jobs tabs, use the Import button on the New York Retirement List page:

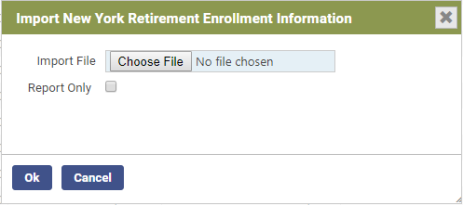

Clicking this button opens the Import New York Retirement Enrollment Information dialog:

Select the .cvs file from the location where it is saved. If you want to generate a report of the enrollment data to review before actually importing it to Workforce, select the Report Only check box and click Ok. The New York Retirement Import Listing and an error listing will be generated and sent to myReports.

If you are satisfied with the enrollment data and are ready to import it to Workforce, deselect Report Only and click Ok.

Note: When uploading the enrollment file to the state, make sure to account for the time needed for the state to return the .csv file of NYSLRS IDs and employment statuses.

Human Resources > State Requirements > NY > Retirement List

Human Resources > State Requirements > NY > System Settings Maintenance > Retirement List button

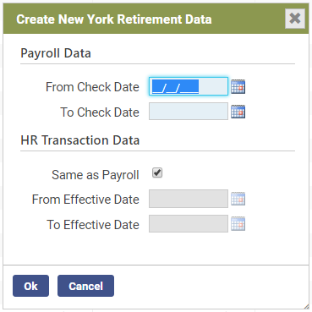

Once you have completed the setup and are ready to create an on-screen work file of the data to be submitted to the Retirement System of New York, click the Create button on the New York Retirement List page. The Create New York Retirement Data dialog opens:

In the Payroll Data section, select the From Check Date and To Check Date of the payroll date range to be reported. The create process looks for wages and contributions for every check date that falls within the date range selected.

If you want the create process to include job events and new hires that have occurred within a date range that differs from the payroll date range, deselect the Same as Payroll check box in the HR Transaction Data section, and select the From Effective Date and the To Effective Date. If you want the create process to include job changes and new hires that have occurred within the same date range as the From Check Date and To Check Date selections, leave Same as Payroll selected.

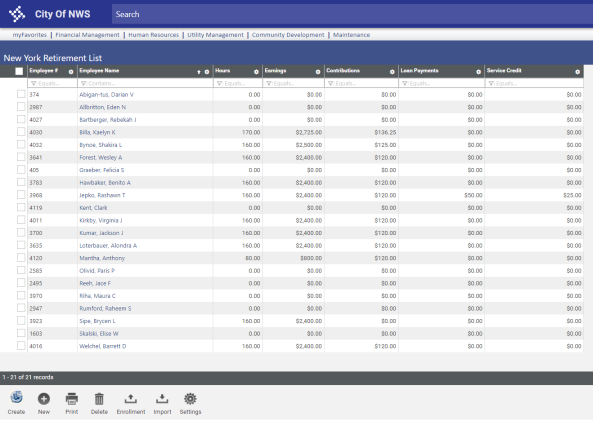

After making your selections, Click Ok. If retirement data has been created previously, a dialog will ask whether you want to overwrite the data. If you click OK, employee data for the date range(s) selected populates the grid on the New York Retirement List page:

The grid summarizes the hours, earnings and contribution payments of each employee.

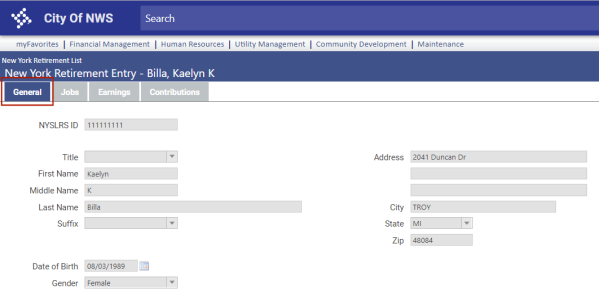

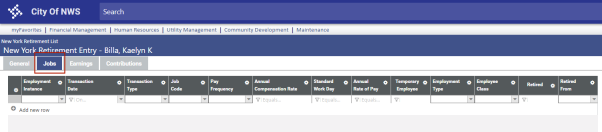

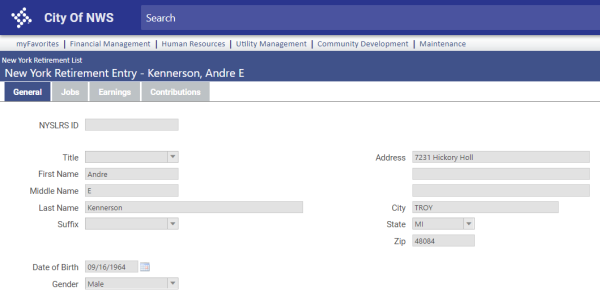

To review an employee's detailed data, click the Employee Name. The New York Retirement Entry page for that employee opens. This page contains four tabs: General, Jobs, Earnings and Contributions.

Demographic data on the General tab of the New York Retirement Entry page comes from Workforce Administration and is display-only.

If the employee has been enrolled in the retirement system, the system ID appears in the NYSLRS ID field. This state-provided ID comes from the NYSLRS ID UDF on the employee's Workforce Employment tab:

If any data on this tab is incorrect, correcting it in Workforce updates it here automatically.

If the employee had any job events within the date range reported, those events appear in the Jobs tab grid of the New York Retirement Entry page:

If necessary, you may add, edit and delete rows.

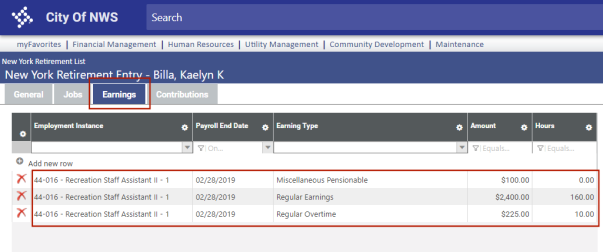

The employee's earnings associated with the hours code mappings in System Settings Maintenance appear in the Earnings tab grid of the New York Retirement Entry page:

If necessary, you may add, edit and delete rows.

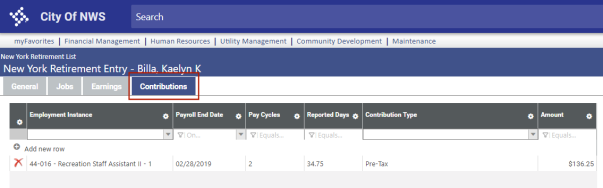

Data on the employee's Contributions tab grid comes from the benefit and deduction mappings in System Settings Maintenance:

If the employee has a job with an employment instance, it appears in the Employment Instance column.

The Payroll End Date column contains the To Check Date selected on the Create New York Retirement Data dialog.

The Pay Cycles column shows how many check dates occurred within the From Check Date and To Check Date range selected on the Create New York Retirement Data dialog.

Reported Days equal the total hours from the Earnings tab divided by the daily hours from the employee's Workforce Jobs tab.

If necessary, you may add, edit and delete rows.

To add an employee to the retirement list, click the New button on the New York Retirement List page. The Add Employee dialog opens:

Select the Employee and click Ok. The New York Retirement Entry page opens with the employee's demographic data loaded on the General tab:

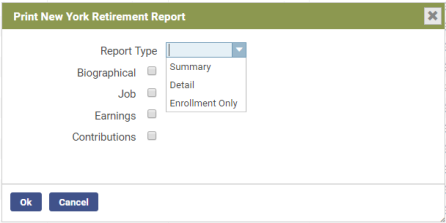

To generate the New York Retirement Listing and transmittal file, click the Print button on the New York Retirement List page. The Print New York Retirement Report dialog opens:

Using the Report Type field and the check boxes, you may select the types and amount of data you want to see on the report; however, regardless of whether you run the report in summary or detail, the transmittal file that is created with the report contains all data.

Selecting Enrollment Only generates a report showing only the New York Retirement List employees who do not have the state-provided NYSLRS ID or NYSLRS Employment Instance. This data needs to be submitted to the state, which in turn provides the IDs and employment instances.

Click Ok to generate the listing and transmittal file.

On the transmittal file, records 1 through 4 break down as follows:

- Record 1 = biographical data (new hires only)

- Record 2 = job data (anything that changes an employee's employment or job data, mapped in System Settings Maintenance

- Record 3 = days and contributions (mapped in System Settings Maintenance)

- Record 4 = wage reporting (employee paid an hours code mapped in System Settings Maintenance)

Records 1 and 2 constitute the enrollment file. Records 3 and 4 constitute the payroll file.

Note: To navigate from the New York Retirement List page to System Settings Maintenance, click the Settings button.